The Collapse of Avia Solutions Group Continues: AirExplore Is Next in Line

Another subsidiary of Avia Solutions Group—the Slovak ACMI operator AirExplore—will soon cease to exist as an independent company. BLACKLIST.AERO was informed of this by a source within the company.

However, AirExplore’s exit from the market has been decided not to be formalized through bankruptcy or creditor protection, as was done with SmartLynx Airlines a month earlier. At that time, the public disclosure of SmartLynx’s debts and the publication of the full list of creditors on the BLACKLIST.AERO website had devastating consequences for Avia Solutions Group bonds, which were issued in 2023 in the amount of USD 300 million. Immediately after that news appeared on BLACKLIST.AERO, ASG bonds fell from 95 cents to 85 cents. At one point they even dropped to 77 cents, below the psychological threshold of 80 cents, under which investors begin to treat bonds as effectively in default.

At a meeting on Friday, January 16, AirExplore management informed staff that the company would be merged with another ASG subsidiary, the Lithuanian operator KlasJet. The fact that KlasJet operates in the business aviation segment while AirExplore is active in passenger transportation no longer surprised anyone. It became clear to all that this “merger” is merely a disguised form of bankruptcy. However, AirExplore’s debts will now legally become the debts of KlasJet. What the management of the Lithuanian operator—already not in the strongest financial position—will do about this will be interesting to observe going forward.

In addition, at the same meeting, the company’s CEO, Martin Stulajter—who had worked at AirExplore for 16 years and was its founder—announced that he was leaving the company. BLACKLIST.AERO attempted to obtain a comment from him, but Martin Stulajter chose to ignore the request. He also declined to comment on one of the possible reasons behind AirExplore’s downfall, information about which was also provided to BLACKLIST.AERO by a source within the company.

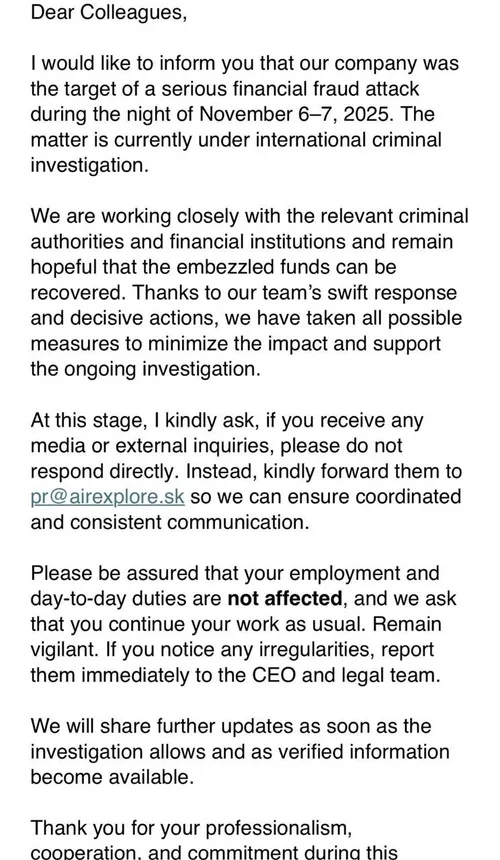

In November 2025, AirExplore management informed employees in writing that the company had become “the target of a serious financial fraud attack during the night of November 6–7, 2025.” According to BLACKLIST.AERO, the amount involved exceeded EUR 3 million. As management later explained unofficially to some employees, the money had been sent to “the wrong company.”

In truth, scammer activity in the aviation market is nothing new. Over the past 5–7 years, dozens of companies have faced situations in which scammers first gained access to internal company networks by hacking email accounts, studied correspondence with counterparties—who pays whom and for what—and then sent emails purportedly from those counterparties, closely resembling previous correspondence. Typically, such emails stated that the company’s banking details had changed and that payments should now be made to a new bank account.

Another fraudulent scheme involves a maintenance or fuel company receiving an invitation to participate in a tender from a major airline. All stamps and signatures appear to be in place. Even close scrutiny reveals nothing suspicious. However, once the invited company decides to participate and submits its tender documents, it receives a “notification” stating that a large deposit must be paid to take part in the tender.

Personally, I know of four cases in which attempts to implement these two schemes were successful, and scammers managed to extract sums ranging from several tens of thousands of dollars to USD 250,000. But an amount as high as EUR 3 million at once—this seems unprecedented in the aviation market.

Frankly speaking, AirExplore employees reacted to this news with skepticism. They concluded that it was merely a pretext to explain why half of their salaries for October 2025 were not paid and why salaries were significantly reduced starting in November. At that time, it was also already known that the company owed money to many counterparties for services rendered, and these non-payments had begun shortly before the alleged scam attack.

Of course, it would be speculative to suspect AirExplore’s management—or, even more reprehensibly, Avia Solutions Group—of siphoning off cash liquidity ahead of an impending de facto bankruptcy. It is better to wait for the conclusions of the police, whom, according to AirExplore management’s statement, the company had contacted.

Everyone is also free to judge for themselves whether the scandalous exit of SmartLynx Airlines from the market, and now AirExplore, represents a certain pattern—or merely a chain of coincidences (or, heaven forbid, the intrigues of ill-wishers and speculative media reporting). However, I would still advise holders of those Avia Solutions Group bonds to examine the group’s internal reporting with the assistance of professional forensic compliance agencies. Then there will be no need to read tea leaves about which company from ASG’s extensive deck might fall next—or about the future of this aviation holding as a whole.

Artem Degtiarov, Chief editor at BLACKLIST.AERO

Companies listed as creditors of SIA SmartLynx Airlines and belonging to the Avia Solutions Group holding structure have declined to pursue court claims against what was once their sister company. This became known after the deadline for submitting creditor claims to the insolvency administrator expired.

Companies listed as creditors of SIA SmartLynx Airlines and belonging to the Avia Solutions Group holding structure have declined to pursue court claims against what was once their sister company. This became known after the deadline for submitting creditor claims to the insolvency administrator expired.

When a loved one requires urgent medical evacuation, families are often forced to act fast — emotionally and financially. In July 2024, one such family contracted EMS Air Ambulance & Medical Repatriation Ltd, a UK-based company offering bedside-to-bedside repatriation. What followed was not just a logistical failure — it was a masterclass in how carefully drafted contracts can trap vulnerable clients and make recovery of funds nearly impossible.

When a loved one requires urgent medical evacuation, families are often forced to act fast — emotionally and financially. In July 2024, one such family contracted EMS Air Ambulance & Medical Repatriation Ltd, a UK-based company offering bedside-to-bedside repatriation. What followed was not just a logistical failure — it was a masterclass in how carefully drafted contracts can trap vulnerable clients and make recovery of funds nearly impossible.

Global Aviation Register of Defaulter companies BLACKLIST.AERO is now an officially registered trademark across the countries of the European Union. This week, the European Union Intellectual Property Office finally issued our long-awaited certificate!

Global Aviation Register of Defaulter companies BLACKLIST.AERO is now an officially registered trademark across the countries of the European Union. This week, the European Union Intellectual Property Office finally issued our long-awaited certificate!

The year 2025 turned out to be one of the most difficult for aviation as a whole. One can talk endlessly about the heavy legacy of the post-COVID era, which manifested itself in a global disruption of supply chains and, as a consequence, a shortage of new aircraft and spare parts, delays in maintenance, and so on. Added to this were geopolitical risks—at times it seems the whole world wants to fight more than to create. We are living through a turning point, where the old world order has already been completely destroyed, while the new one has not yet taken on any clear shape. Aviation, in this process, is a litmus test reflecting all of these dynamics.

The year 2025 turned out to be one of the most difficult for aviation as a whole. One can talk endlessly about the heavy legacy of the post-COVID era, which manifested itself in a global disruption of supply chains and, as a consequence, a shortage of new aircraft and spare parts, delays in maintenance, and so on. Added to this were geopolitical risks—at times it seems the whole world wants to fight more than to create. We are living through a turning point, where the old world order has already been completely destroyed, while the new one has not yet taken on any clear shape. Aviation, in this process, is a litmus test reflecting all of these dynamics.