IS IT FAIR TO PROSECUTE OTHER COMPANIES OF THE DEFAULTER? OUR OPINION: YES!

We often encounter situations where a company accumulates debts and ceases its activity. But at the same time, the former owners of this company are opening under a new sign and continue the same song, only in a new way.

Is it fair to call for aviation market participants to stop doing business with ALL companies owned by the owner of a particular defaulting company? Below I will state the reasons why we consider it necessary.

When a particular Claimant submits a case to the BLACKLIST.AERO Registry, our team begins to study the defaulting company and collect information from various sources. And very often we are faced with the fact that although a particular company has ceased active operations (declaring or not declaring bankruptcy), its activities continue under a new sign. And the staff migrates from one company to another in whole teams.

Thus, formally, the new company has nothing to do with the debts of the old one. That allows the same people (often they hide behind fictitious top managers) to continue unscrupulous activities. If a creditor sues the old company that has accumulated debts to him, then he is simply forced to spend money and time on a process that can rarely end in debt recovery. By the time of the trial in court, the debtor company has no property, all working capital has been withdrawn.

The only way to achieve justice is to completely block the activities of specific people who breed companies year after year to receive fraudulent profits.

Legal procedures can help achieve such a result in only 5% of cases. To do this, the creditor needs to spend a huge amount of money and several years of litigation in an attempt to prove what everyone already knows. As a rule, the result financially does not justify the effort expended.

So, we have a situation where everyone knows everything about everything, but no one supposedly “can do anything”. If this is not a lie, then it is a self-deception. Let's just think - why has this practice become ubiquitous in the aviation market? Our answer: because other market participants allow scammers to operate in this way. Deliberately or out of ignorance and unwillingness to dig deeper - it happens in different ways.

There is a way out of this situation - self-regulation of the aviation market. Market participants should stop saying every time “Hello again!” to the old crooks. Because if non-payers see that other market participants are ready to deal with them “from scratch”, thus leaving the victim companies alone with their problems, then this motivates such scammers to do their dirty deeds again and again.

We at BLACKLIST.AERO are confident that all participants in the aviation market bear their share of responsibility for the current situation with non-payments. Only the professional solidarity of market participants can change the flow of non-payments. Namely, refusal to cooperate with any companies related to specific non-payers.

Only the realization by the owners of the defaulting company of the fact that their actions threaten their entire business, that the aviation community will simply throw them out of the market, will become a significant factor of pressure on them.

Do not wait for manna from heaven and complain about the lack of certain regulations! The mechanism for solving the problem of non-payments is in our hands!

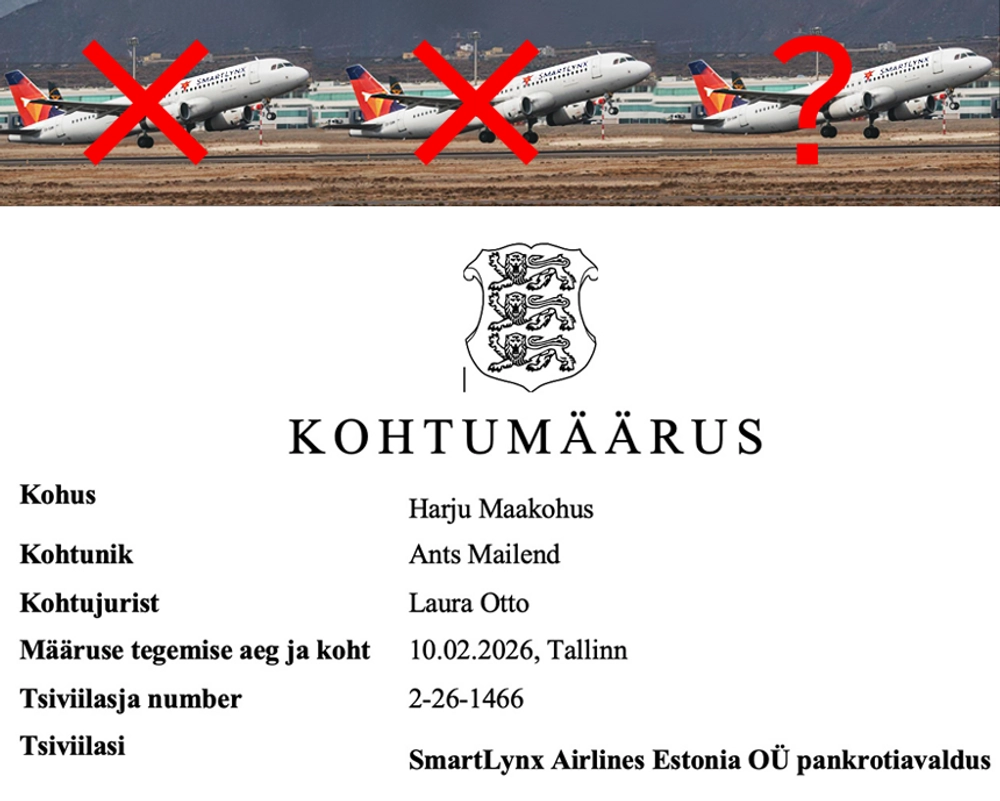

A new bankruptcy has emerged involving an airline previously belonging to Avia Solutions Group. Following the collapse of SmartLynx Airlines Latvia, bankruptcy proceedings have now been initiated for SmartLynx Airlines Estonia OÜ. A copy of the decision by the Tallinn district court Harju Maakohus to open bankruptcy proceedings was obtained by the administration of BLACKLIST.AERO from a source within the legal community.

A new bankruptcy has emerged involving an airline previously belonging to Avia Solutions Group. Following the collapse of SmartLynx Airlines Latvia, bankruptcy proceedings have now been initiated for SmartLynx Airlines Estonia OÜ. A copy of the decision by the Tallinn district court Harju Maakohus to open bankruptcy proceedings was obtained by the administration of BLACKLIST.AERO from a source within the legal community.

Companies listed as creditors of SIA SmartLynx Airlines and belonging to the Avia Solutions Group holding structure have declined to pursue court claims against what was once their sister company. This became known after the deadline for submitting creditor claims to the insolvency administrator expired.

Companies listed as creditors of SIA SmartLynx Airlines and belonging to the Avia Solutions Group holding structure have declined to pursue court claims against what was once their sister company. This became known after the deadline for submitting creditor claims to the insolvency administrator expired.

When a loved one requires urgent medical evacuation, families are often forced to act fast — emotionally and financially. In July 2024, one such family contracted EMS Air Ambulance & Medical Repatriation Ltd, a UK-based company offering bedside-to-bedside repatriation. What followed was not just a logistical failure — it was a masterclass in how carefully drafted contracts can trap vulnerable clients and make recovery of funds nearly impossible.

When a loved one requires urgent medical evacuation, families are often forced to act fast — emotionally and financially. In July 2024, one such family contracted EMS Air Ambulance & Medical Repatriation Ltd, a UK-based company offering bedside-to-bedside repatriation. What followed was not just a logistical failure — it was a masterclass in how carefully drafted contracts can trap vulnerable clients and make recovery of funds nearly impossible.

Another subsidiary of Avia Solutions Group—the Slovak ACMI operator AirExplore—will soon cease to exist as an independent company. BLACKLIST.AERO was informed of this by a source within the company.

Another subsidiary of Avia Solutions Group—the Slovak ACMI operator AirExplore—will soon cease to exist as an independent company. BLACKLIST.AERO was informed of this by a source within the company.